NEW Forecast Predicts United States will Continue to Struggle for International Inbound, Domestic Business Travel

United States Trailing Global Competitors; National Leadership Increasingly Critical

PRESS RELEASE January 17, 2024

WASHINGTON -

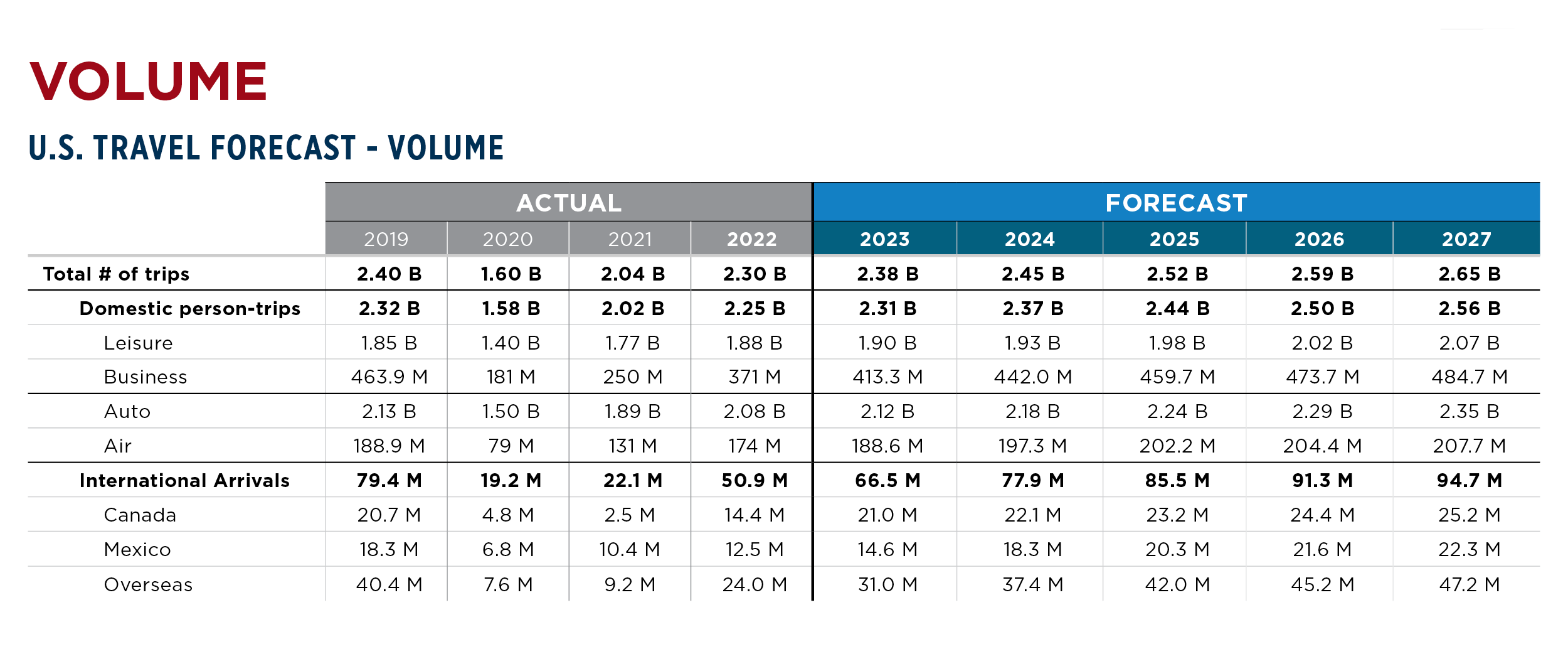

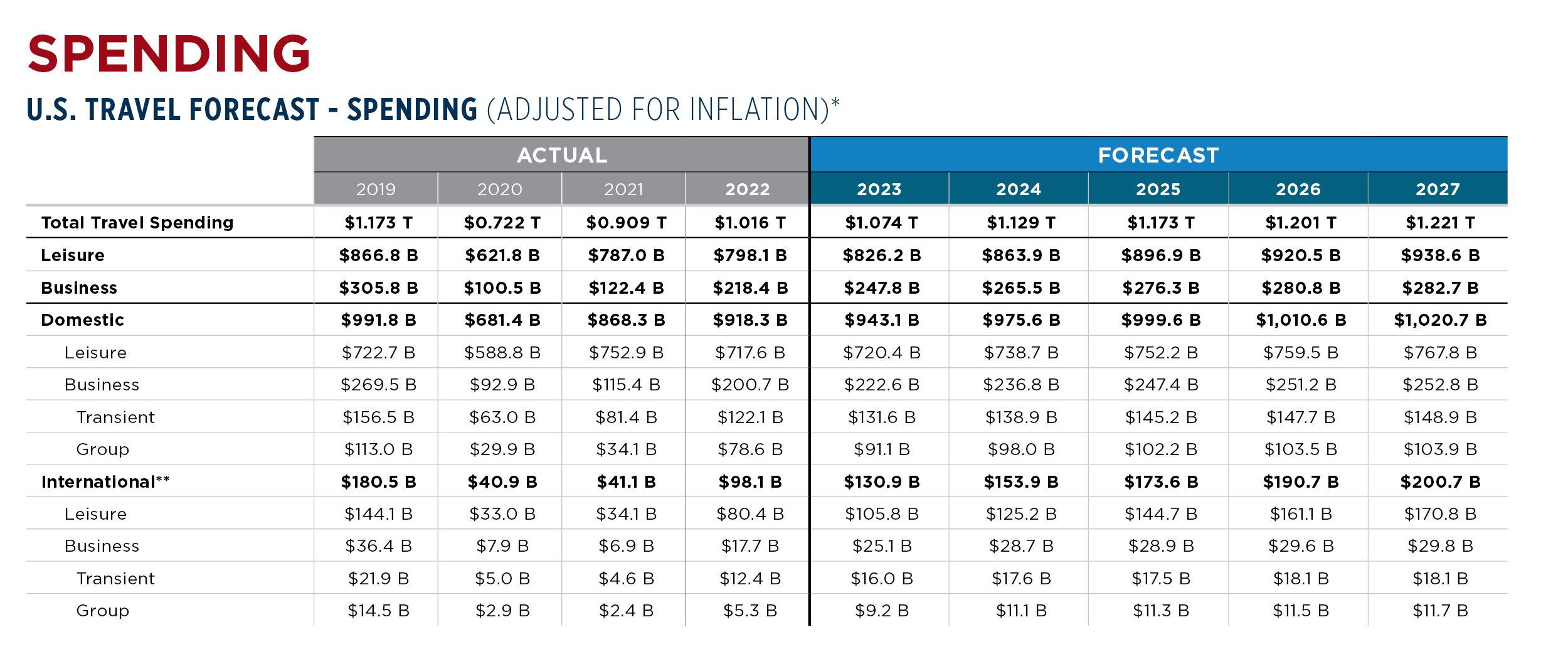

The U.S. Travel Association today released its biannual forecast for travel to and within the United States through 2027, showing international inbound travel and domestic business travel will continue to remain below pre-pandemic levels in 2024. The forecast, prepared by Tourism Economics, was released just days after U.S. Travel revealed the findings of a global competitiveness report conducted by Euromonitor International. The report found the U.S. ranked 17th out of 18 top markets for travel due to decades of underinvestment and a lack of focus and coordination from federal policymakers.

“While we inch back to pre-pandemic travel numbers, other countries are actively advancing strategies to gain international visitors and are now ahead of the United States in the race to win back the global travel market,” said U.S. Travel Association President and CEO Geoff Freeman. “The federal government can and must enact specific policies to jumpstart a more seamless, efficient and globally competitive travel industry.”

Forecast Findings

|

|

International travel to the U.S. growing quickly but still far from a full pre-pandemic recovery. An expected global macroeconomic slowdown, a strong dollar, and lengthy visa wait times could inhibit future growth, with volume reaching 98% of 2019 levels in 2024 (up from 84% recovered in 2023) and achieving a full recovery in 2025. Spending levels, when adjusted for inflation, are not expected to recover until 2026.

Other countries with whom the U.S. directly competes have recovered their pre-pandemic visitation rates more quickly, and some countries—such as France and Spain—have even increased their share of the global travel market. Meanwhile, U.S. global market share is declining.

Business travel is still expected to grow in 2024, albeit at a slower rate. Volume in the sector is expected to end the year at 95% of 2019 levels—up from 89% recovered in 2023. Slowing economic growth will hinder domestic business travel’s recovery, with a full comeback in volume not expected until 2026. Domestic business travel spending is not expected to recover to pre-pandemic levels within the range of the forecast.

Domestic leisure growth decelerated through three quarters of 2023 as consumer spending slowed amid higher borrowing costs, tighter credit conditions and the restart of student loan repayments. The sector achieved a full recovery to pre-pandemic levels in 2022.

Policies to Grow Travel

There are several policies within the federal government’s control that can accelerate travel growth and increase global competitiveness:

- Lower U.S. visitor visa interview wait times, which approach an average of 400 days in top visa-requiring inbound markets.

- Reduce Customs wait times at U.S. airports and other ports of entry experiencing excessive delays.

- Accelerate the deployment of biometric entry-exit security screening systems at U.S. airports.

- Improve the overall air travel experience through a long-term Federal Aviation Administration reauthorization bill.

- Increase federal prioritization and focus on travel industry growth, as other countries have done.

In conjunction with the new Euromonitor analysis, U.S. Travel launched a solutions-oriented Seamless and Secure Travel Commission. The commission—comprised of former government officials and private sector experts—is tasked with making additional policy recommendations to modernize the travel experience, increase U.S. competitiveness and facilitate growth. The commission plans to release its recommendations in autumn 2024.

See the full forecast report.

U.S. Travel Association is the national, non-profit organization representing the $1.3 trillion travel industry, an essential contributor to our nation's economy and success. U.S. Travel produces programs and insights and advocates for policies to increase travel to and within the United States. Visit ustravel.org for more information.